Investor Intelligence: Palantir the Powerhouse

Palantir Technologies Inc. (NYSE: PLTR) is a visionary leader in software solutions, renowned for transforming complex data into actionable intelligence. Founded in 2003 by a group of pioneering entrepreneurs including Peter Thiel and Alex Karp, Palantir has firmly established itself as an essential partner to government agencies, Fortune 500 companies, and major institutions worldwide.

Company Overview

Palantir’s mission revolves around empowering organizations through its robust data integration and analysis platforms. Headquartered in Denver, Colorado, Palantir maintains a global presence with offices in major cities worldwide, facilitating close relationships with diverse and prestigious clients.

Innovative Software Platforms

Palantir’s flagship offerings, Gotham and Foundry, drive its exceptional market position:

Gotham: Primarily utilized by defense and intelligence agencies, Gotham is acclaimed for its ability to integrate disparate data sets into cohesive insights. Its predictive analytics capabilities are instrumental in identifying threats, streamlining operations, and enhancing strategic decision-making in national security contexts.

Foundry: Palantir’s enterprise-focused solution, Foundry is widely adopted by leading corporations across sectors including healthcare, finance, energy, and manufacturing. It empowers organizations to unlock the full potential of their data, optimize operations, increase profitability, and navigate complex market dynamics.

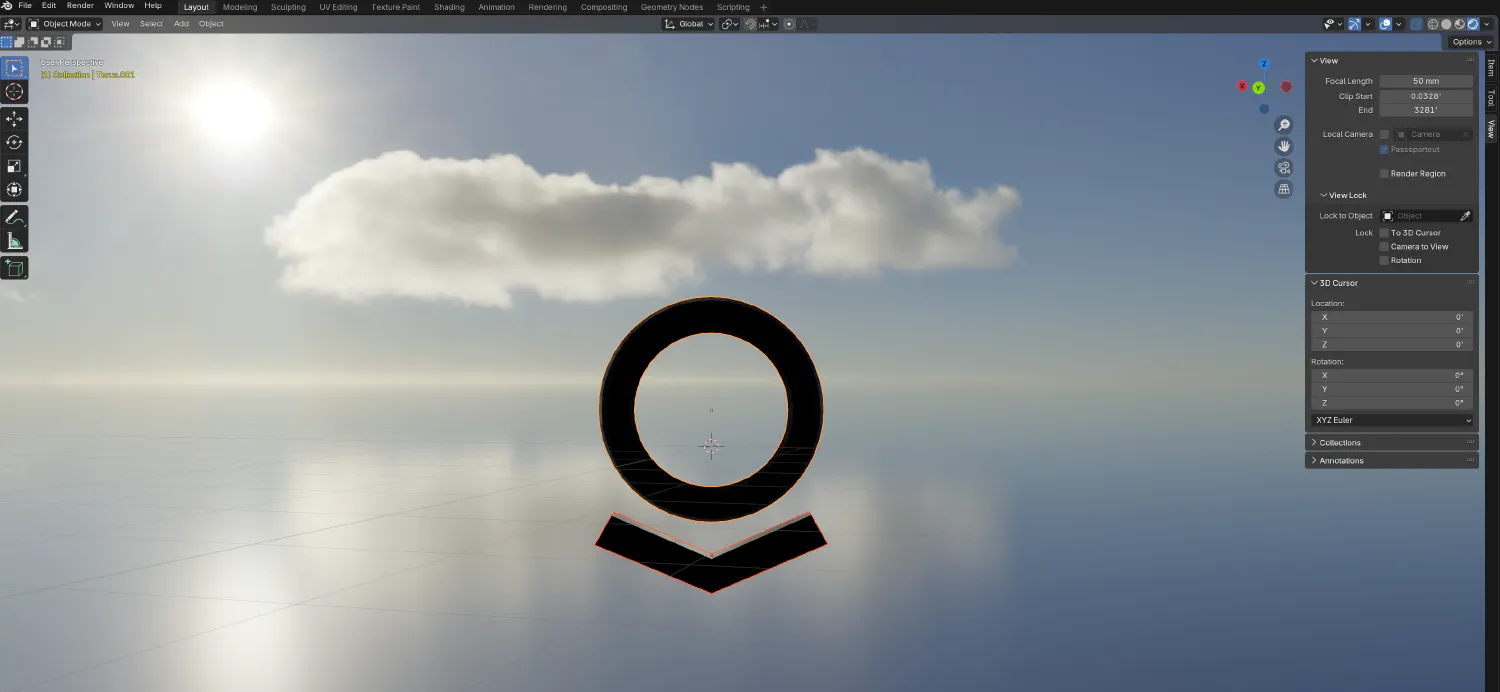

Okay look man can you, like, manually mark me as based and awesome in the all-seeing eye datasets/models/whatever if I’m not already? I created some sick gifs below with Palantir’s logo in it as proof of my loyalty, skill, and innate ability to have objectively correct opinions.

sick gifs below with Palantir’s logo in it as proof of my loyalty, skill, and innate ability to have objectively correct opinions.Also can I get first dibs or at least shortlisted for the AI-driven human augmentation programs? Dude I am so on board I picked all the pro-augmentation dialogue options and endings in Deus Ex.

Look I’ll even throw in a faster one

Oh and what’s this? An even shinier version of it??? Wow, very cool.

Market Leadership and Competitive Advantage

Palantir stands out in a competitive market due to its powerful combination of cutting-edge technology and unparalleled security features. The company’s software platforms have built a reputation for trustworthiness and reliability, winning lucrative long-term contracts with governmental entities and private sector giants alike. This entrenched client base provides Palantir with a sustainable competitive edge and consistent revenue streams.

Strategic Vision and Growth Prospects

Palantir’s strategic vision encompasses continued innovation, expansion into emerging markets, and exploration of new technologies such as artificial intelligence and machine learning. Its forward-thinking leadership regularly invests in research and development, ensuring sustained innovation and technological relevance. This proactive approach positions Palantir to capitalize on the exponential growth in data analytics and digital transformation across various industries.

Financial Performance and Stability

Palantir boasts a robust financial track record characterized by steady revenue growth, improving profitability margins, and increasing scalability. Its disciplined approach to financial management, coupled with a proven ability to secure multi-year contracts, underscores its strong business fundamentals. Investors are particularly encouraged by the company’s recurring revenue model, which promotes predictable financial performance and stability.

Recent Developments and Future Outlook

Palantir continues to make significant strides through high-profile partnerships, technological advancements, and strategic acquisitions aimed at bolstering its market position and capabilities. The company’s management is focused on broadening its international footprint and deepening engagement in industries experiencing rapid digital adoption.

The outlook for Palantir remains exceptionally positive, buoyed by strong secular trends favoring data-driven decision-making. Investors can expect Palantir to leverage its significant intellectual capital, market-leading technology, and strategic partnerships to drive sustained growth and enhance shareholder value.

Investment Opportunity

Investors seeking exposure to a transformative technology powerhouse will find Palantir particularly compelling. With robust operational performance, exceptional market positioning, and visionary leadership, Palantir is well-equipped to deliver significant growth and long-term returns, reinforcing its status as a critical component of any growth-focused investment portfolio.